Roblox (RBLX)·Q4 2025 Earnings Summary

Roblox Crushes Q4 as DAUs Surge 69% — Stock Jumps 21% After Hours

February 5, 2026 · by Fintool AI Agent

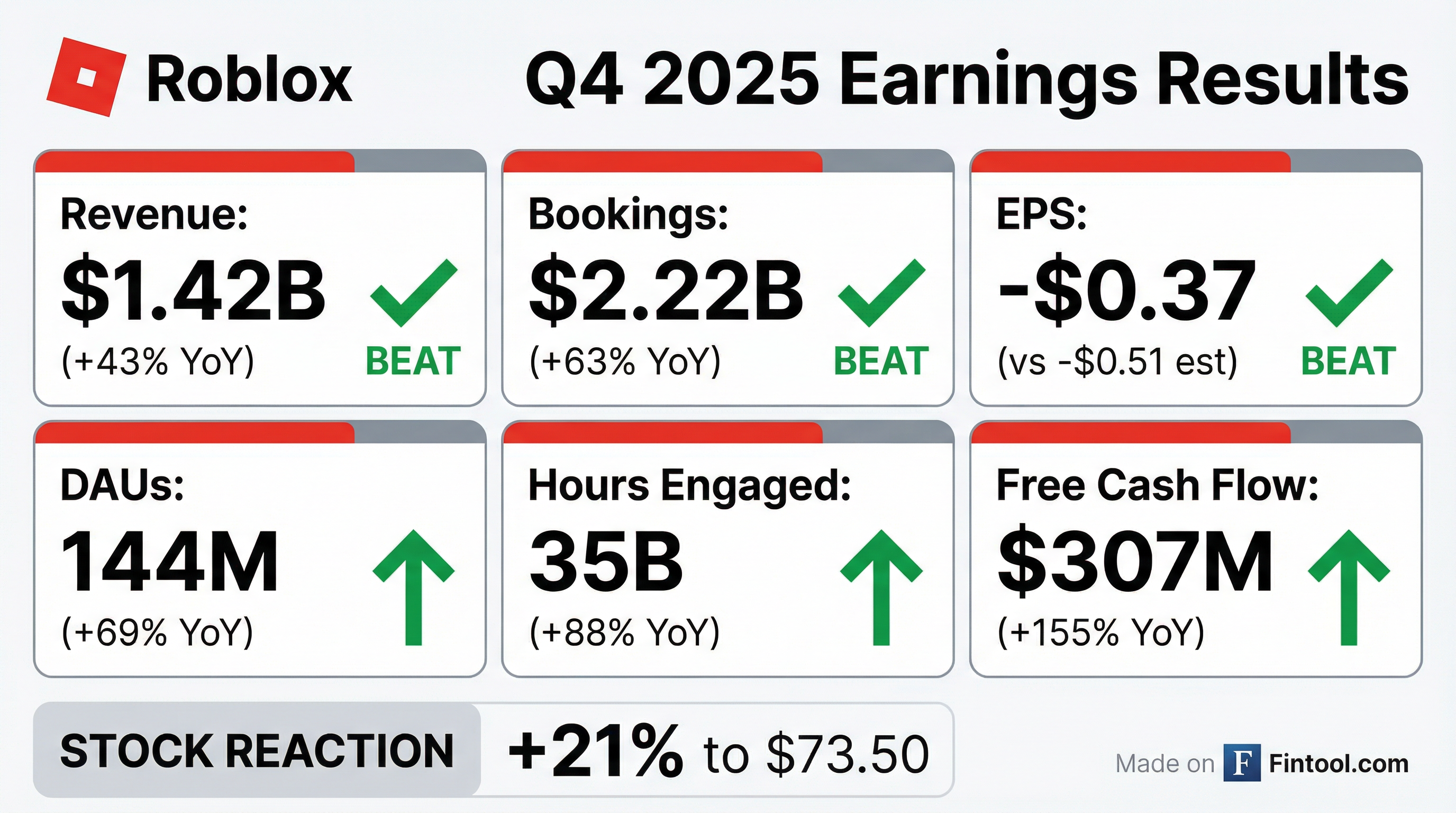

Roblox delivered a blowout Q4 2025, beating across the board as the gaming platform's user growth accelerated dramatically. Revenue grew 43% year-over-year to $1.42 billion, bookings surged 63% to $2.22 billion, and daily active users hit a record 144 million (+69% YoY). The stock jumped 21% to $73.50 in after-hours trading, reversing earlier weakness.

Management called fiscal 2025 "a banner year" with full-year revenue up 36% to $4.9 billion and bookings up 55% to $6.8 billion—significantly exceeding both annual guidance and long-term targets.

Did Roblox Beat Earnings?

Yes — decisively. Roblox beat on revenue, EPS, and all key operating metrics.

Values based on S&P Global consensus estimates.

The quarter delivered operating leverage despite heavy investments. Free cash flow growth of 155% on 63% bookings growth demonstrates the scalability of Roblox's platform.

What Were the Key Operating Metrics?

Roblox's operating metrics showed exceptional strength across the board:

Geographic diversification accelerated, with DAUs outside the U.S. and Canada growing 79% while domestic DAUs grew 32%. Hours growth was strongest in APAC, with the U.S. and Canada still delivering robust 41% growth.

How Did the Stock React?

The stock closed at $60.51 on February 5 (-4.01% for the day) but surged 21% to $73.50 in after-hours trading following the earnings release.

The after-hours surge reflects the magnitude of the beat across all key metrics, particularly the acceleration in user growth and engagement that exceeded already-high expectations.

What Did Management Guide?

Roblox provided strong guidance for Q1 2026 and full-year 2026:

Q1 2026 Guidance

FY 2026 Guidance

Management noted that revenue and bookings growth is expected to be higher in the first half versus the second half due to tougher Q3/Q4 2025 comparisons.

Key guidance change: Roblox will stop providing annual guidance starting in 2027, shifting to quarterly-only guidance. CFO Naveen explained: "We've learned that it's difficult to predict exactly where this business will land 12 months out... When Roblox set guidance [for 2025], Steal a Brainrot and Grow a Garden had not even launched. That's created a situation where the company has had to provide relatively conservative guidance. I don't think that's helpful to investors."

What Changed From Last Quarter?

Several notable shifts emerged in Q4:

1. Age-Check Rollout — Short-Term Headwind, Long-Term Opportunity

Management disclosed that age verification revealed a younger user base than self-reported data suggested. Of users who have age-checked (45% of DAUs as of Jan 31):

- 35% are under 13

- 38% are 13-17 years old

- 27% are over 18

The age-check rollout created mid-single-digit headwind to engagement and low-single-digit headwind to bookings in the short term, as lost hours came primarily from less engaged users. However, management is "more confident that over time, these enhancements can enable even higher levels of engagement than what we saw prior to the age-check rollout."

2. Older Demographic Growth Accelerating

The over-18 cohort is growing at 50%+ annually—more than double the rate of under-18 DAUs—and monetizes 40% higher. Roblox currently reaches fewer than 10% of U.S. adults aged 18-34 daily, representing significant whitespace.

3. DevEx Rate Increase Flowing Through

The 8.5% increase in DevEx rates announced in September 2025 contributed to 70% YoY growth in developer exchange fees to $477 million. Top 1,000 creators earned an average of $1.3 million in 2025, up over 50% year-over-year.

4. Content Diversification Without Viral Hits

Q4 saw strong growth without relying on new viral experiences. Experiences outside the top 10 accounted for more than half of Robux spending growth, with 68% engagement growth and 53% spending growth in the long tail.

What Strategic Initiatives Did Management Highlight?

AI Investments

Roblox has deployed over 400 AI models across the platform for creation, discovery, safety, and social communication. Key initiatives announced this week include:

- 4D Generation: Launched this week, allowing experiences to include creation of new objects via AI prompting

- Cube 3D/4D: Proprietary foundation model expanded to functional interactive simulation

- World Model: Internal team using "not just video data but internal Roblox data" for creation and world-building

- Photo Upsampling: Cloud-based 2D and 3D upsampling for higher photorealism

- NPC Training: Using 13 billion hours of intrinsic 3D world data to train AI-powered characters

- Safety Models: Open-sourced voice toxicity classifier via Ruse Consortium

Dave emphasized: "Every day, we capture roughly 30,000 years of human interaction data on Roblox in a PII and privacy-compliant way." Management sees AI as a tailwind for expanding beyond gaming into entertainment, communication, and commerce.

Platform Technical Innovations

Several critical technical advancements were highlighted for genre expansion:

- Native Streaming: Full cloud rollout of native streaming for 2D and 3D assets with various LODs (levels of detail)

- SLIM (Dynamic Asset Compositing): Cloud-based compositing of complex assets delivered at various detail levels for all devices

- Native Server Authority: Critical for competitive gaming genres like shooters

- Custom Matchmaking: Creators can now optimize for latency, age, or social connection

- Avatar System Expansion: Complete release in H1 2026 with higher fidelity and more articulation

Management emphasized the platform is designed so "the exact same gaming experience should run very well and at high performance on low-end 2-gigabyte Android, and at the same time blossom into high-res on a PC or console."

Infrastructure Investment

Roblox is adding a third core data center to support growth and resiliency, migrating AI workloads from third-party cloud to owned GPU infrastructure, and expanding edge data centers for latency improvements.

CapEx will see a "slight uptick" in 2026 due to GPU landing in data centers and memory price inflation.

Advertising Expansion

Rewarded Video ads are now widely available with 90% completion rates and 95% viewability across 1,000+ brands. A new Homepage Feature ad format launched in January 2026. While advertising revenue remains "modest," management is "bullish about the long-term potential for mass market advertising on Roblox."

How Are Margins Trending?

Roblox continues to operate at a GAAP loss but showed leverage on a cash flow basis:

The DevEx and infrastructure investments are intentional as Roblox reinvests in the flywheel. Management expects margins flat to slightly down in FY2026 due to higher DevEx rates, infrastructure/safety investments, and safety marketing spend.

Long-term view: Management continues to expect long-term margin expansion, though the trajectory will be "non-linear due to varying levels of annual investment."

What Is the Balance Sheet Position?

Roblox ended Q4 with a strong cash position:

The company generated $1.8 billion in operating cash flow for FY2025, up from $822 million in FY2024.

What Are the Key Risks Flagged?

Management highlighted several risk factors in their forward-looking statements:

- Execution on growth strategy — Ability to sustain user/creator growth

- Viral experience unpredictability — Timing and impact of viral hits

- Platform security and availability — Maintaining uptime at scale

- Regulatory changes — Including verified parental consent requirements

- Trust and safety impact — Age-check effects on engagement

- Competitive landscape — AI's impact on platform, users, and creators

- Average lifetime changes — Currently 27 months; changes affect revenue recognition

Q&A Highlights

On Bookings Visibility (Wells Fargo)

Management has "a lot of internal leading indicators" including content diversity, distribution, velocity, and genre reach. Naveen noted Q4's strength came without a major viral hit, with experiences outside the top 10 growing faster than Q3. New users from Q3-Q4 behave like core users in terms of engagement, spend, and retention.

On AI Disruption Concerns (Morgan Stanley)

Dave flipped the narrative: "I would flip it and share how we think about it internally, which is an opportunity for disruption in the opposite direction—an expansion of the Roblox vision beyond gaming into the future mix of what is entertainment." He emphasized Roblox builds multiplayer cloud technology, not video latent-space models, and sees AI as a tailwind for expanding the definition of gaming.

On Gross Margin Improvement (Morgan Stanley)

COGS improvement came from two factors: (1) steering Robux purchases to lower-cost platforms "performed better than anticipated," and (2) bookings leverage against fixed costs. Management expects continued long-term COGS improvement, though not linear.

On Discovery Evolution (Goldman Sachs)

Dave explained Roblox optimizes for long-term user value, not short-term engagement. This has driven increased content diversity—users now engage with 24+ unique experiences per month, up double digits from 2024.

On China Opportunity (J.P. Morgan)

Roblox continues partnering with Tencent and sees "a huge opportunity in China." If they launch in China, it would be air-gapped with infrastructure designed to be deployed in multiple locations.

On Age-Check Behavior Changes (Wolfe Research)

Dave highlighted that age verification enables better age-banded matchmaking, clustering users by age and skill level. He noted another major gaming company and a communications platform have since announced they will follow Roblox's approach.

On Q1 Sequential Decline (Jefferies)

Naveen pushed back on the "glass half empty" framing: "This is a quarter where we do not have, at this point, a big new viral hit. And so to put up 40%-44% top-line growth in the absence of that, I think we should all be very, very excited about what that says about the health of the platform."

Historical Performance

Roblox has now beaten estimates for 8 consecutive quarters:

Values based on S&P Global estimates data.

Forward Estimates

Analyst expectations for the next four quarters:*

Consensus estimates from S&P Global. Subject to change.

Key Takeaways

- Blowout quarter — Beat on all metrics with 69% DAU growth and 63% bookings growth

- Flywheel accelerating — Content diversification, user growth, and monetization all firing

- 18+ opportunity — Older cohort growing 2x faster and monetizing 40% higher

- Age-check tradeoff — Short-term engagement headwind but long-term strategic advantage

- No new viral hits needed — Long-tail content driving growth

- Strong FCF — $307M in Q4, $1.35B for FY2025, scaling faster than bookings

- Guidance methodology change — No more annual guidance starting 2027